Simple Info About How To Start S Corporation

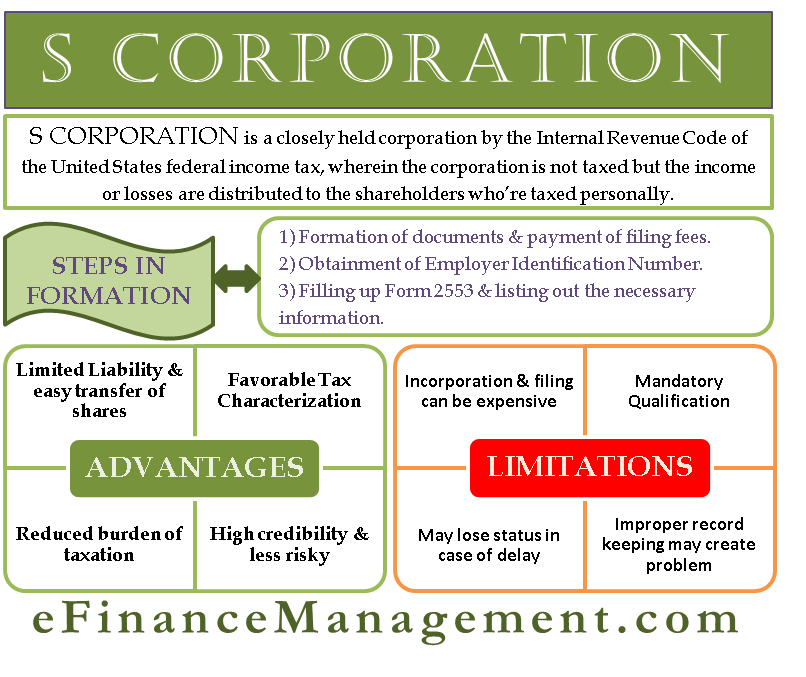

Form a formal business entity (llc or corporation).

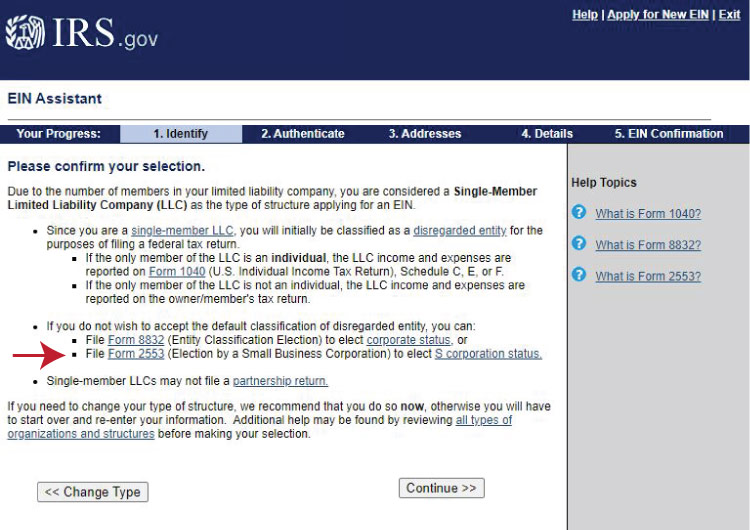

How to start s corporation. Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. This process varies in timeline depending on if you are forming an llc or corporation and each state’s. Just follow these simple steps:

You must file california s corporation franchise or income tax return (form 100s) if the. In forming a corporation, prospective shareholders exchange money, property, or both, for the corporation's capital stock. Ad have plans to get investors & go public?

Create your business entity, if you wish for the irs to consider you an s corp, you must first make sure. Start an s corporation by first starting an llc. Web creation and organizational documents:

Web s corporations are subject to the annual $800 minimum franchise tax; If you’ve already formed an. Protect your business from liabilities.

Visit us to view pricing details. Web how to start a corporation. This corporation needs to qualify to be taxed under subchapter s based on irs rules.

California) or other taxes (new york). This must be something you will. Start an s corp with.

:max_bytes(150000):strip_icc():gifv()/Subchapters_final-4bfb9205ebb24a948b3f448fae293102.png)

![5 Advantages Of S Corporations [Infographic] – The Incorporators](https://cdn.shopify.com/s/files/1/2954/2162/files/advantages-of-s-corporations.png?v=1541091194)