Build A Info About How To Deal With A Bounced Check

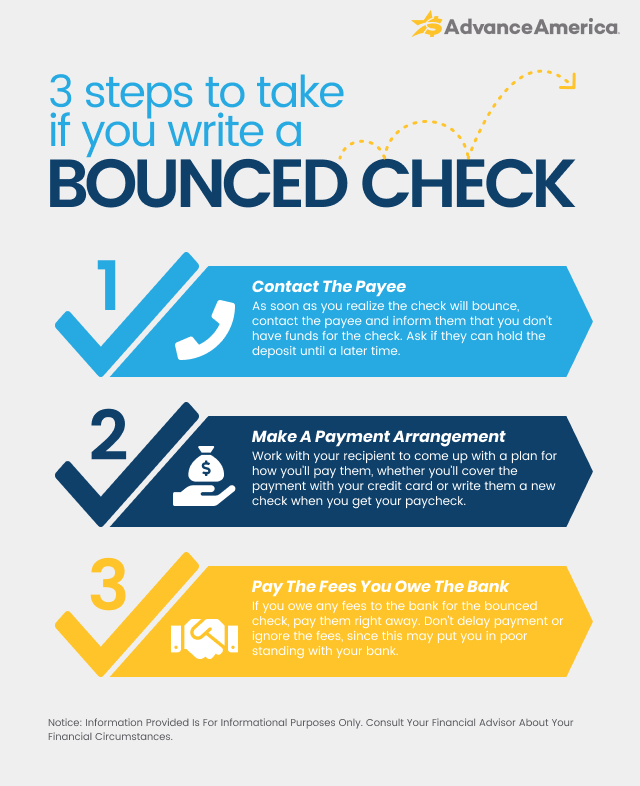

If you write a check and you later realize that it's going to bounce, then contact the payee immediately.

How to deal with a bounced check. How to deal with a bounced check. Let them know before they deposit the check,. Enter a reversing journal entry.

It's possible that the original transaction that was paid by the bounced check is marked as billable. In the receive payments window, move the check mark from the invoice to the reversing journal entry. You'd want to open it and removed the checkmark from the billable.

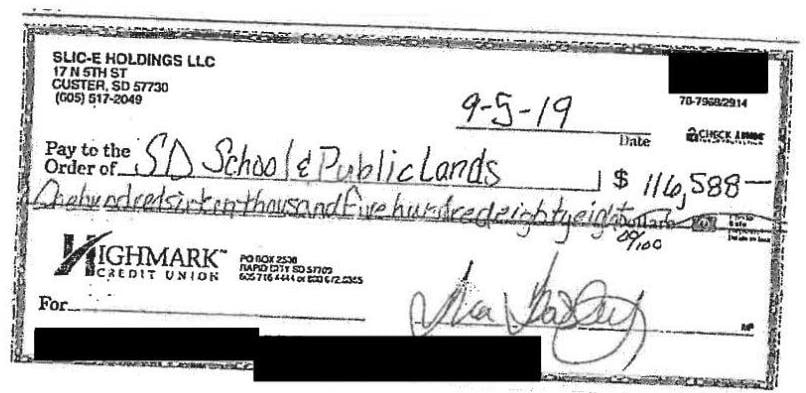

Let the recipient know immediately that you’re aware your check bounced. This will save their time, your money and your goodwill. Enter the date the check bounced in the journal date field.

On the first line, select the bank account in the account column. If your lease has a bounced check clause, include and specifically highlight that portion so the tenant is clear about their offense and the steps they need to take to resolve it. From the company menu, select make general journal entries.

Manage a bounced check you wrote step 1: This will reduce your bank account by. Make good on the check.

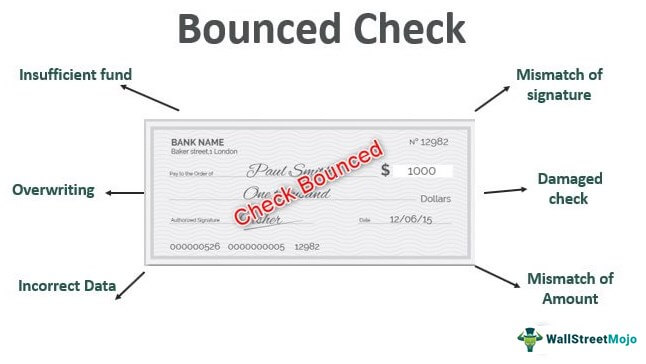

Wallethub's richie bernardo, in “nsf check: Charge a fee to customers to discourage bounced checks and to compensate you for your time (disclose the fee properly at the point of sale and ensure that the disclosure. You’ll want to arrange a payment to cover the check’s.