Simple Tips About How To Correct Form 1096

Do not include blank or voided forms or the form 1096 in your total.

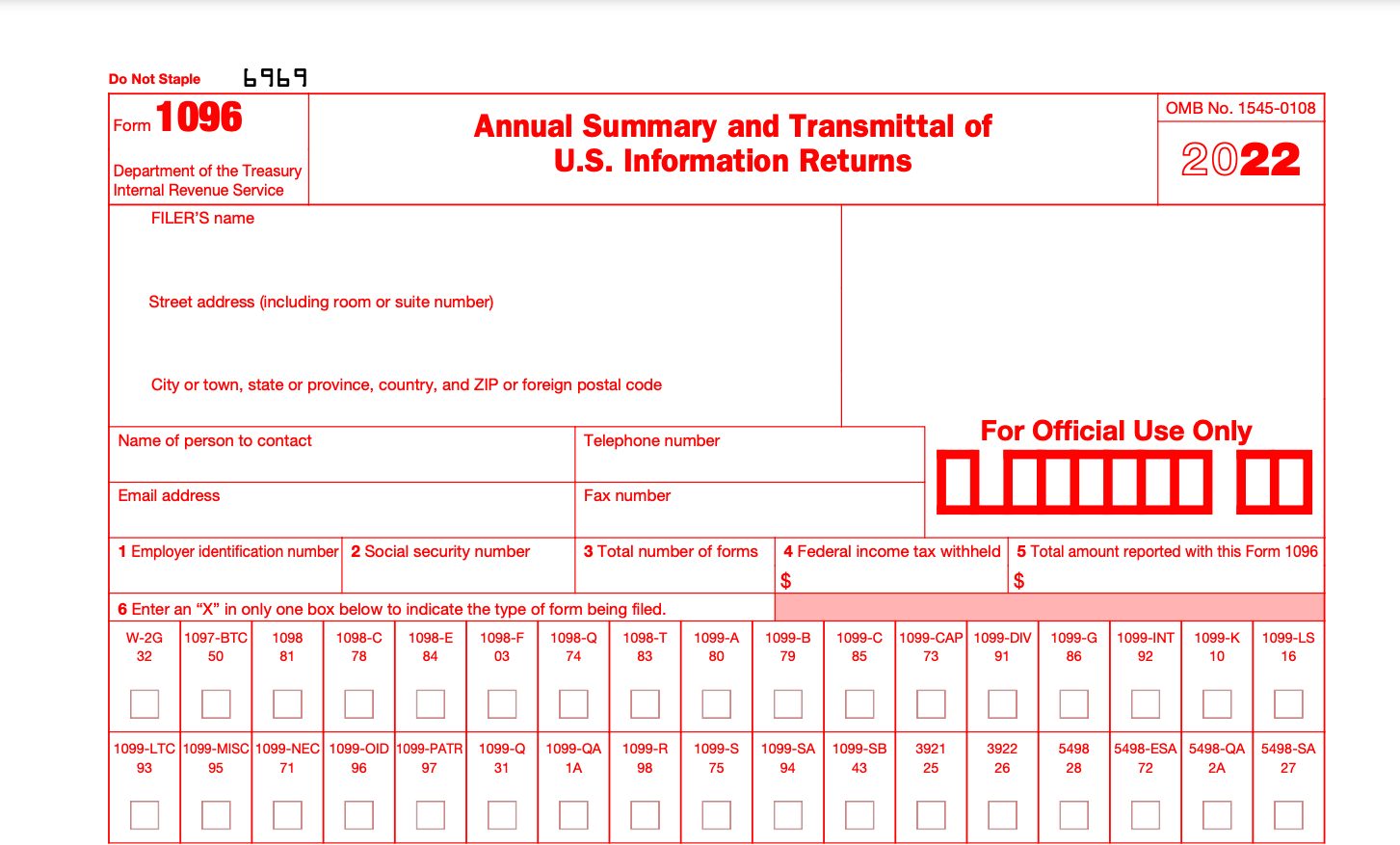

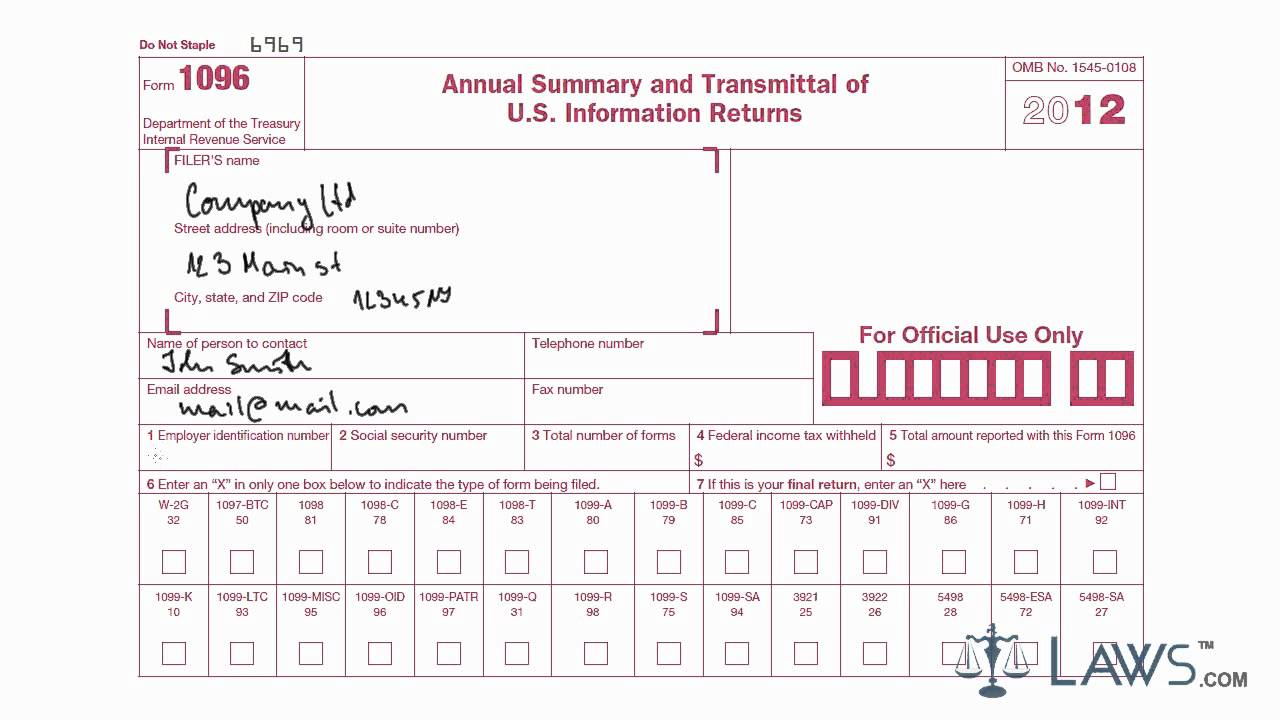

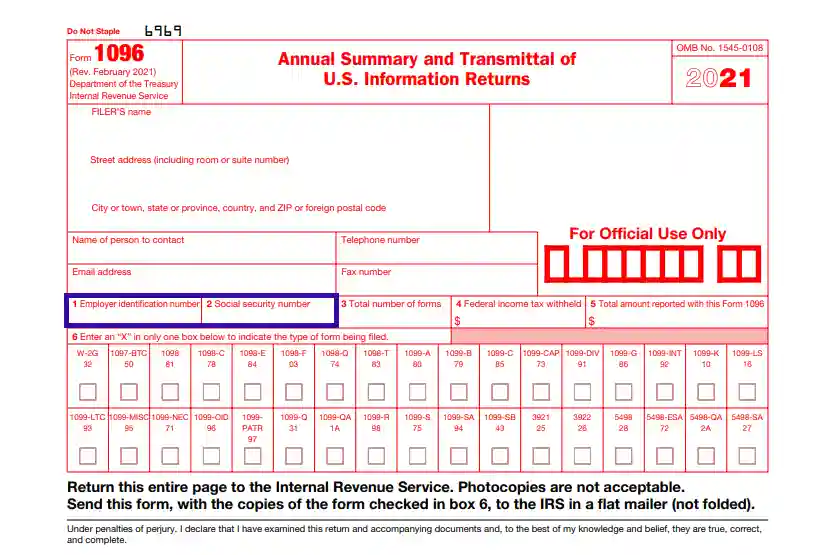

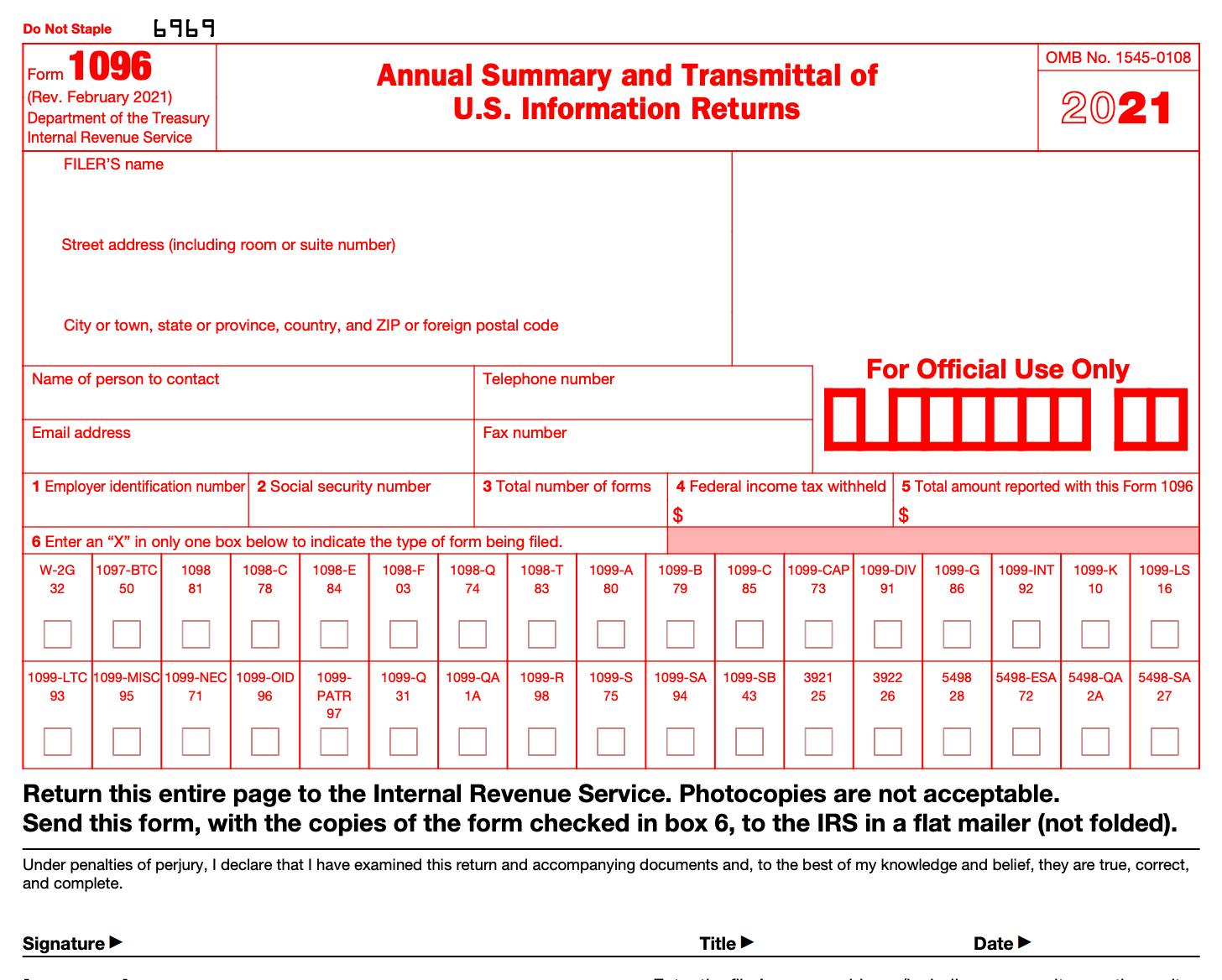

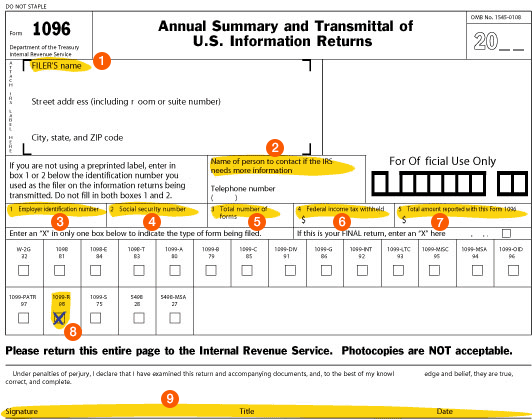

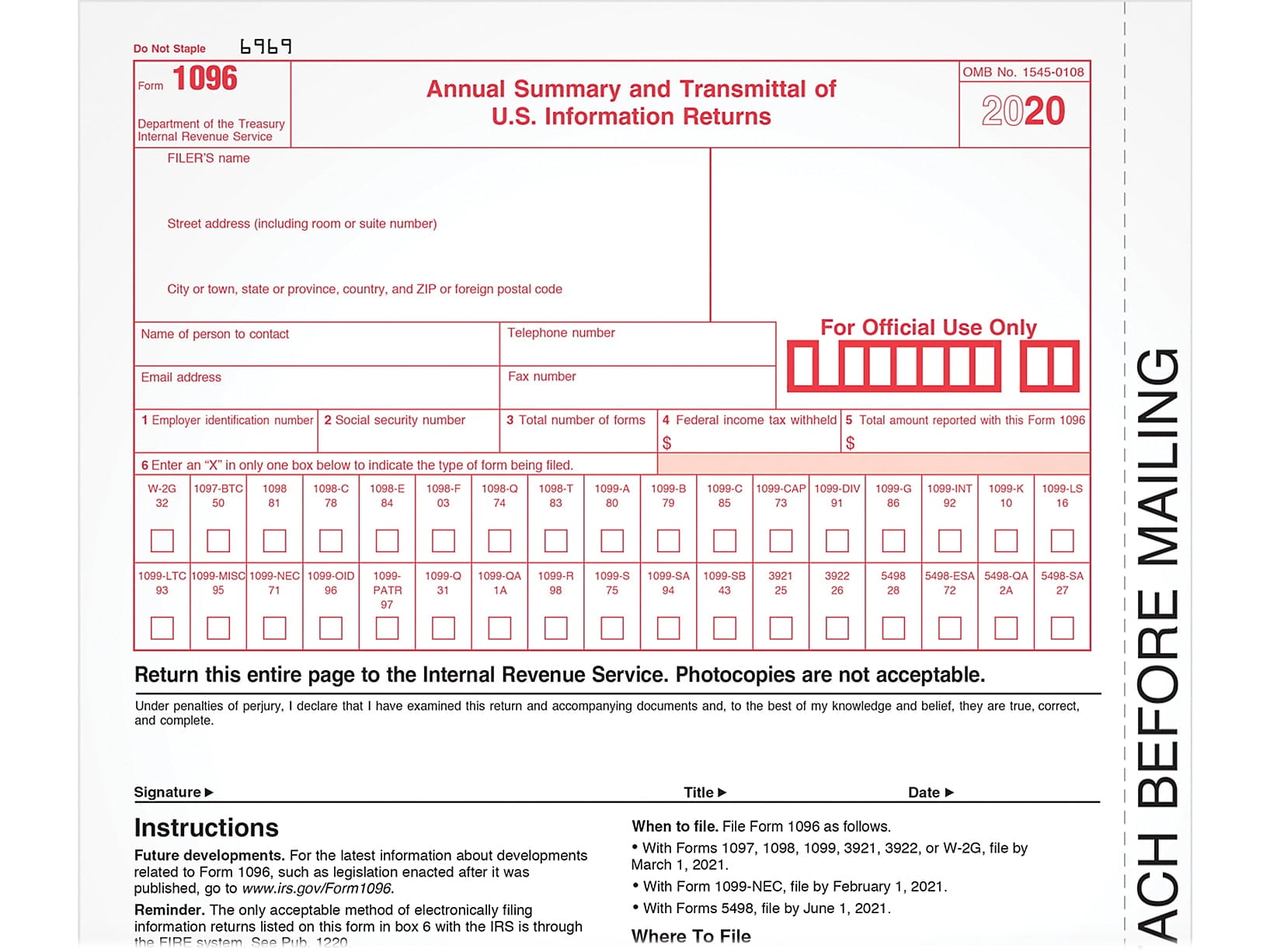

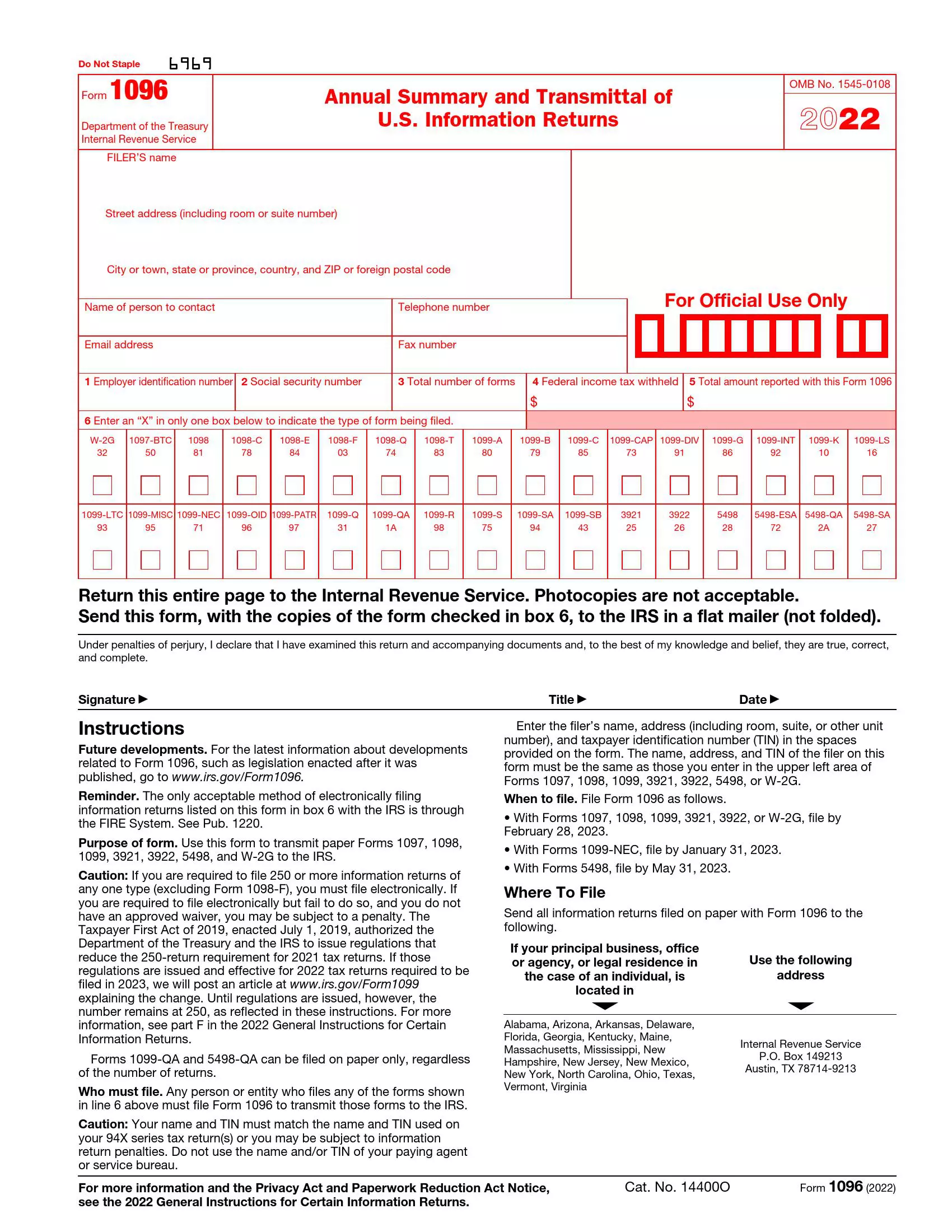

How to correct form 1096. Select the company to process. Prepare a new transmittal form 1096. Enter the number of forms you are transmitting with this form 1096.

File form 1096 and copy a of the return with the. Enter the number of forms you are transmitting with this form 1096. Enter the words filed to correct tin, name, and/or address in the bottom margin of the form.

Open the irs and choose return preparation. Check the box at the top of the form to indicate the filing is a corrected form. Prepare a new information return do not enter an x in the “corrected” box include all the correct information prepare a new form.

Enter the number of correctly completed forms, not the number of pages, being transmitted. In order to correctly file irs form 1096, you’ll complete the form for each of your information returns (remembering that you must use an official version of form 1096 and not print the pdf. Enter the number of correctly completed forms,.

Adjust any recipient information like amount and contact address. Enter the number of correctly completed forms,. Enter one of the following phrases in the bottom margin of the form.

You need to check the box manually. Do not include blank or voided forms or the form 1096 in your total. Prepare a new transmittal form 1096.