Out Of This World Info About How To Avoid Tax On Capital Gains

The capital gains tax is a federal fee you pay on the profit made from selling certain types of assets.

How to avoid tax on capital gains. Besides knowing the rules of each type of business structure, there are additional strategies you can use to avoid capital gains. Live in the house for at least two years. To get around the capital gains tax, you need to live in your primary residence at least two of the five years before you sell it.

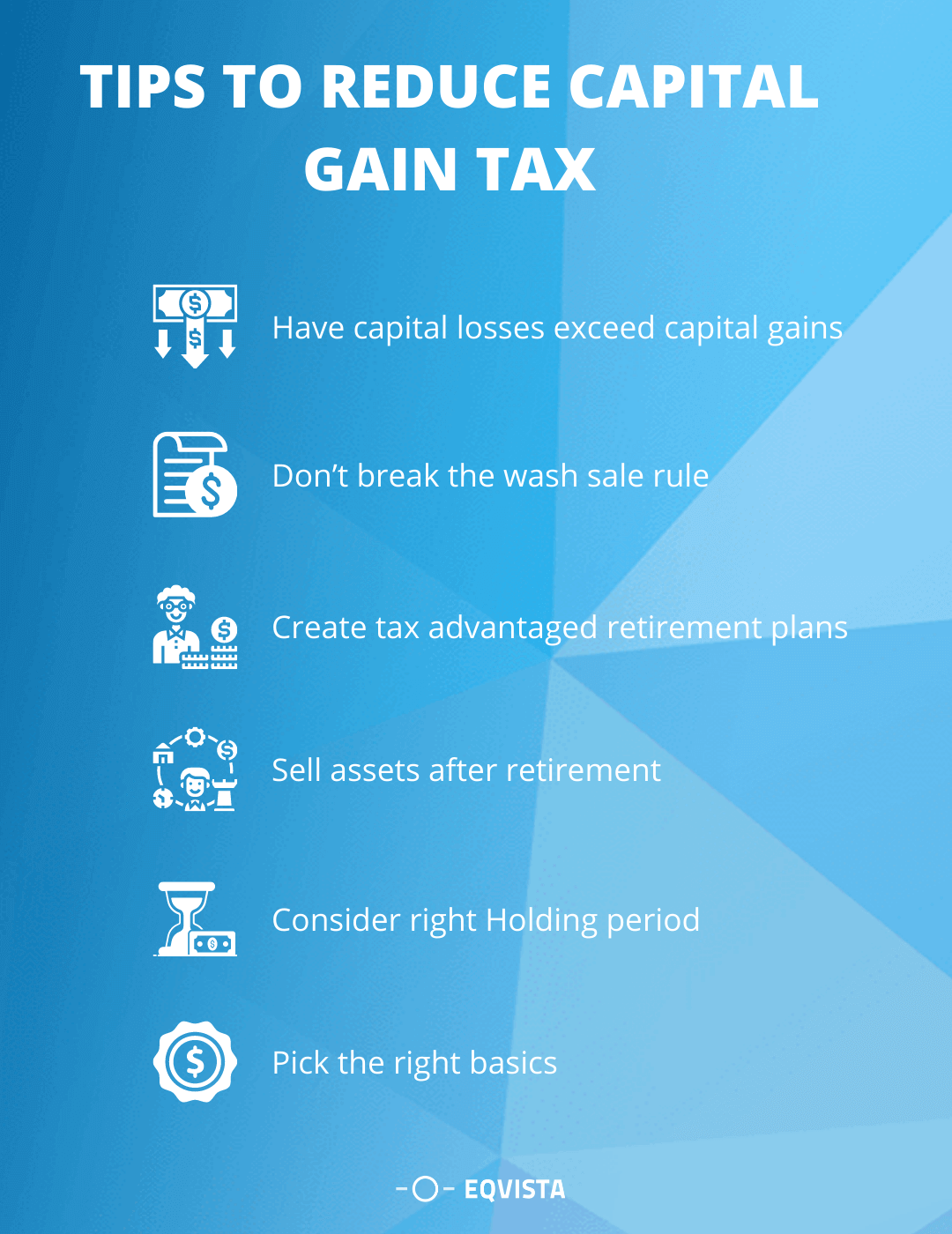

Note that this does not mean you have to own the. How to avoid capital gains tax on your property use the main residence exemption. The main way to reduce your capital gains taxes is by making sure you calculate in all of the reductions that the irs allows to your overall profits.

How to avoid capital gains tax on a home sale. Use a roth ira or roth 401 (k). If you want to make a profit from the sale of your house, you will owe capital gains taxes.

A great way to avoid capital gains tax and also make an impact is to donate a property that has increased in value. If you sell a house that. Another option for reducing the capital gains tax when you sell a rental property is to turn the house into your primary residence before you sell.

Residents must meet all criteria to avoid the capital gains tax on a property sale. These include stock investments or real estate property. A capital gain is calculated as.

First and foremost, the house that the resident is selling should be the primary residence. Do you pay capital gains if you lose money? Put your earnings in a tax shelter.

![Video] Section 1031 Exchange Basics: How To Avoid Capital Gains Tax](https://d2va9d3lkepb6e.cloudfront.net/wp-content/uploads/Section-1031-Exchange-Basics-Video-1024x536.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)