Looking Good Tips About How To Appeal Property Taxes

Ad look for property tax appeal forms now!.

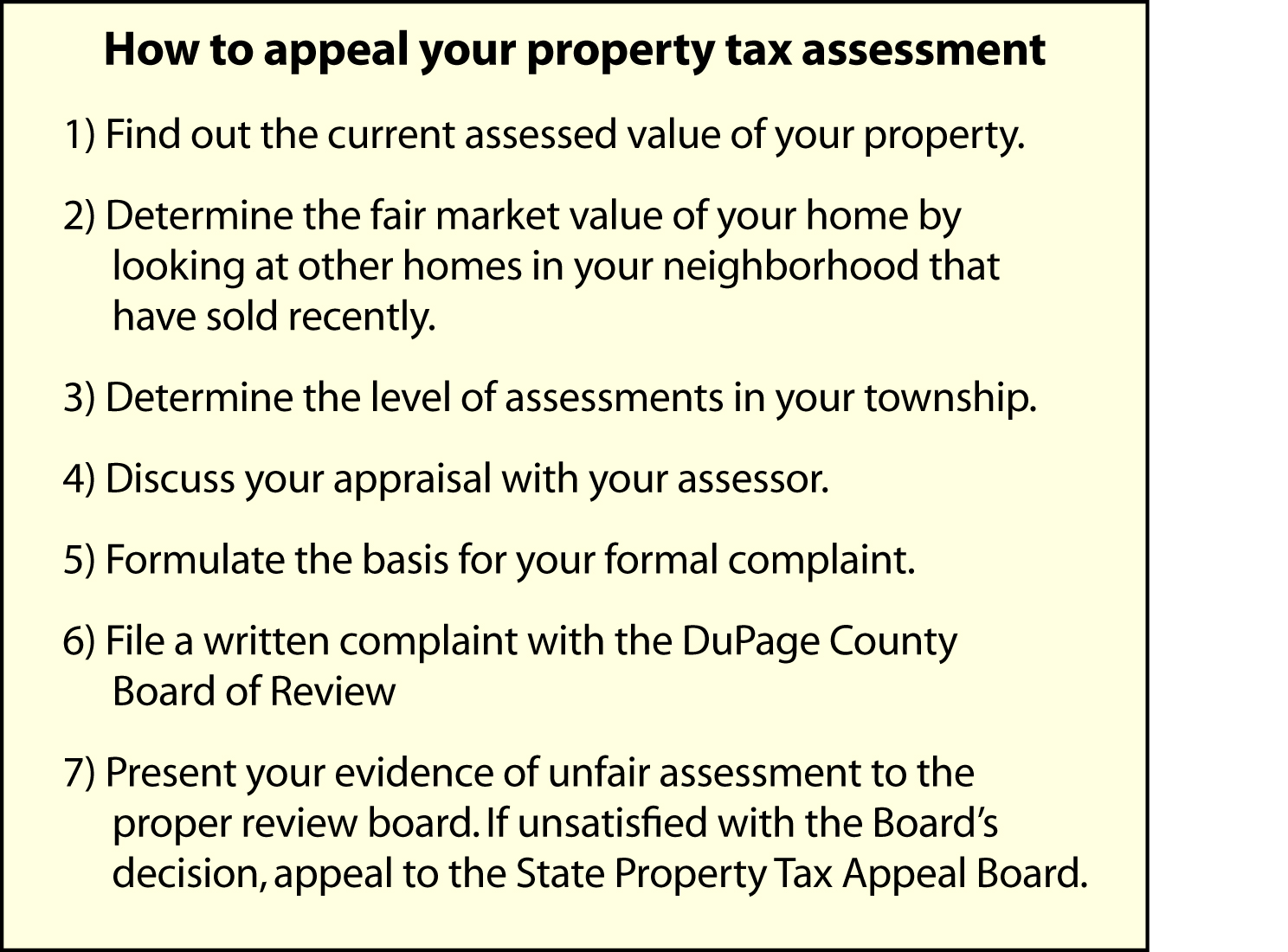

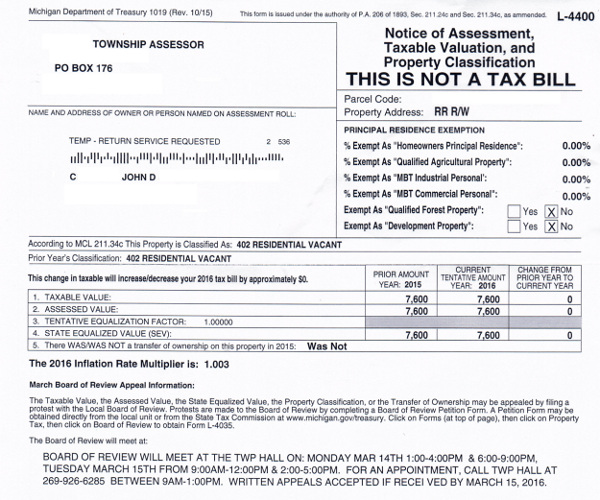

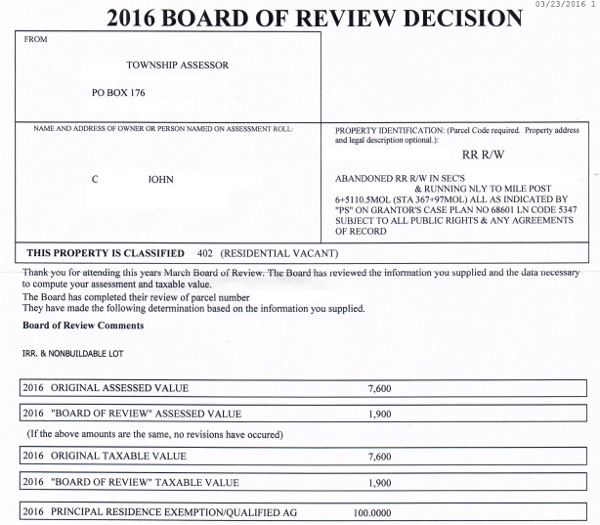

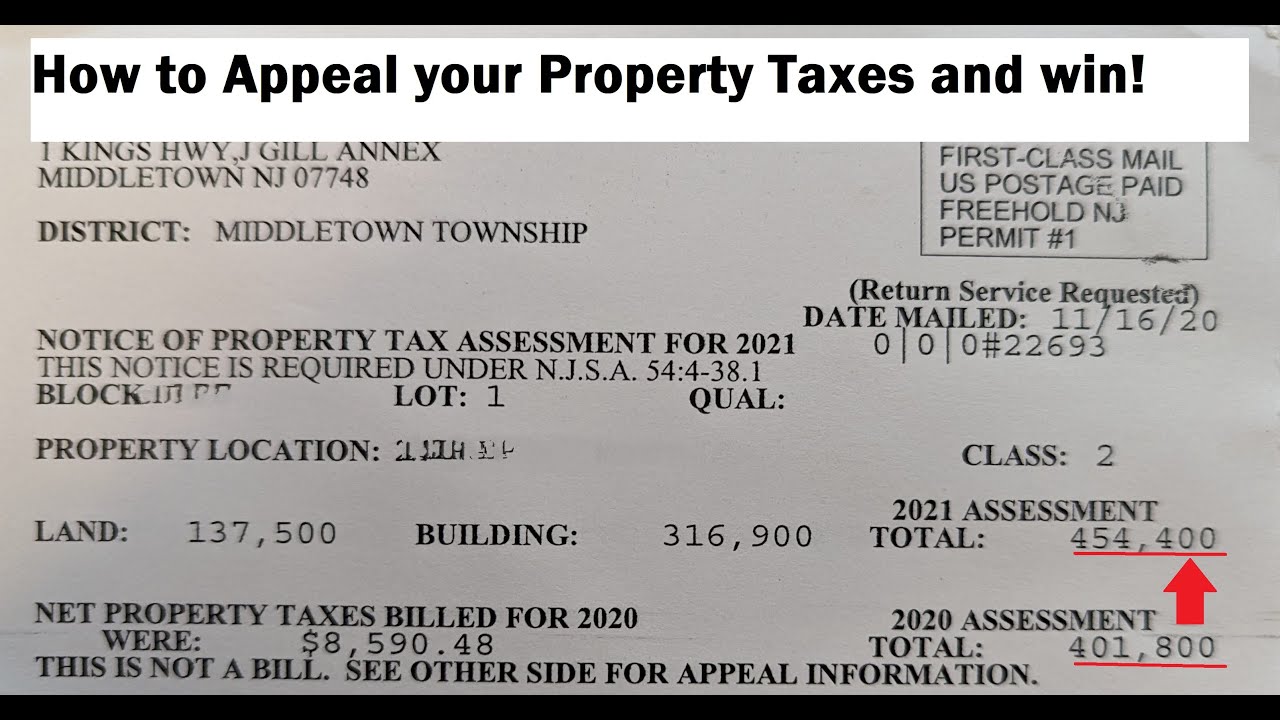

How to appeal property taxes. Ad expert tax specialists helping appeal your li property tax. 23 hours agoproperty tax assessments determine the property value, which is performed by a government assessor who then uses this assessment to calculate the amount of taxes due. The information in this material is not intended as tax or legal advice.

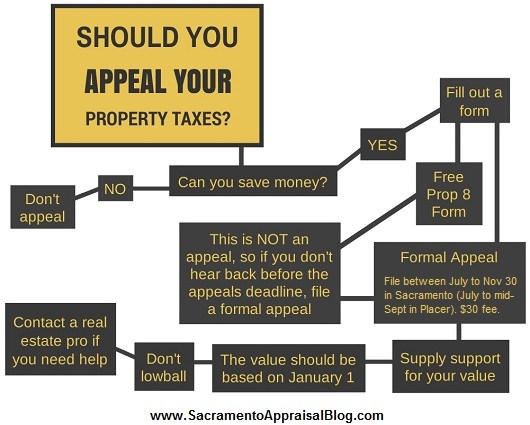

See how much your neighbors have saved or apply today! The taxpayer may appeal any. An appeal can only be filed during certain timeframes.

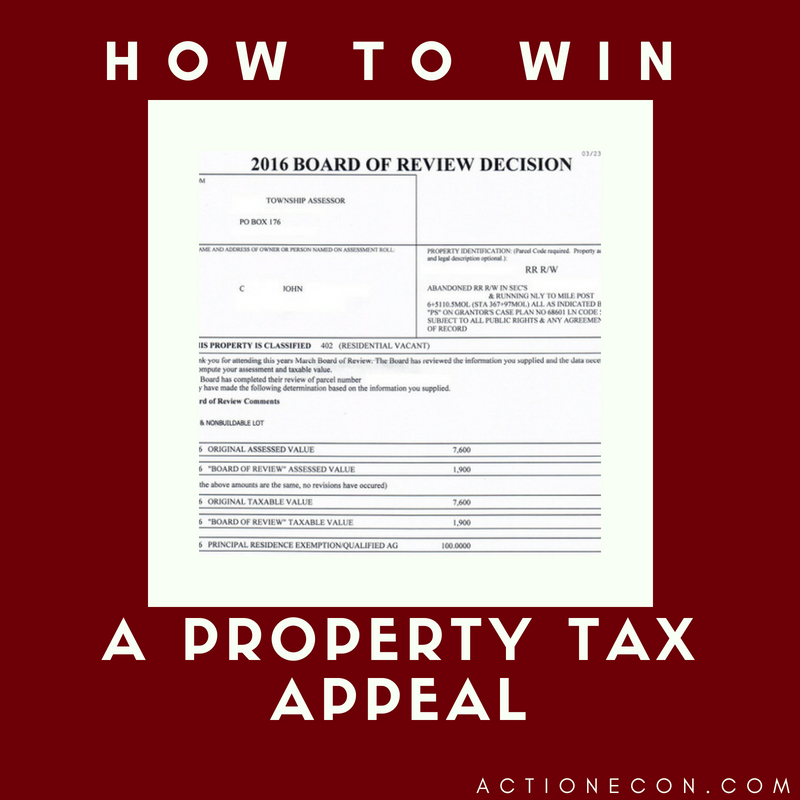

Ad you may qualify to be forgiven for tens of thousands of dollars in taxes. Appeals of assessed valuation are made to the county board of equalization. Filing a property tax appeal.

Learn more or call now! If you do not agree with the county board of review's decision, you can appeal the decision (in writing) to the state property tax appeal board or file a tax objection complaint in circuit. Here we have everything you need

Check for the property tax breaks you deserve. As soon as you receive your proposed property tax. In order to come up with your tax bill, your tax office multiplies the tax rate by.

If you're looking at a modest tax hike, appealing your property taxes may not be worth the. Your local county assessor’s office will likely have applicable fees listed on its. Check your property tax assessor’s website.