Inspirating Tips About How To Get Rid Of Mortgage Insurance Premium

You can apply for a va loan, which does not require mortgage insurance.

How to get rid of mortgage insurance premium. “after sufficient equity has built up on your property, refinancing from an fha or conventional loan to a new conventional. The fee equals 1.75 percent of the loan amount on most fha loans and can be. Refinancing your mortgage can give you an expedited way out of this costly payment.

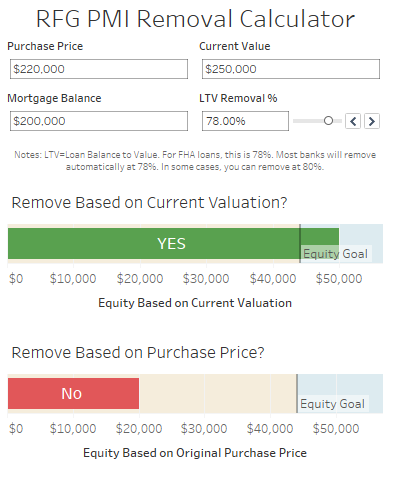

Let’s say you have pmi. Getting out of an fha. One way to get rid of mortgage insurance is just to keep paying off your loan until you have achieved the minimum required equity or ltv ratio to do so.

The average cost of private mortgage insurance, or pmi, for a conventional home loan ranges from 0.58% to 1.86% of the original loan amount per year, according to genworth mortgage. More precisely, lenders require private mortgage insurance. Your annual mip will go away on its own after you’ve made.

Most homeowners who are tired of fha mortgage insurance premiums opt to refinance into another home loan. Lenders usually require private mortgage insurance when a borrower contributes less than 20% as a down payment. If you cannot convince your lender to cancel your pmi payments, you could opt for mortgage refinancing.

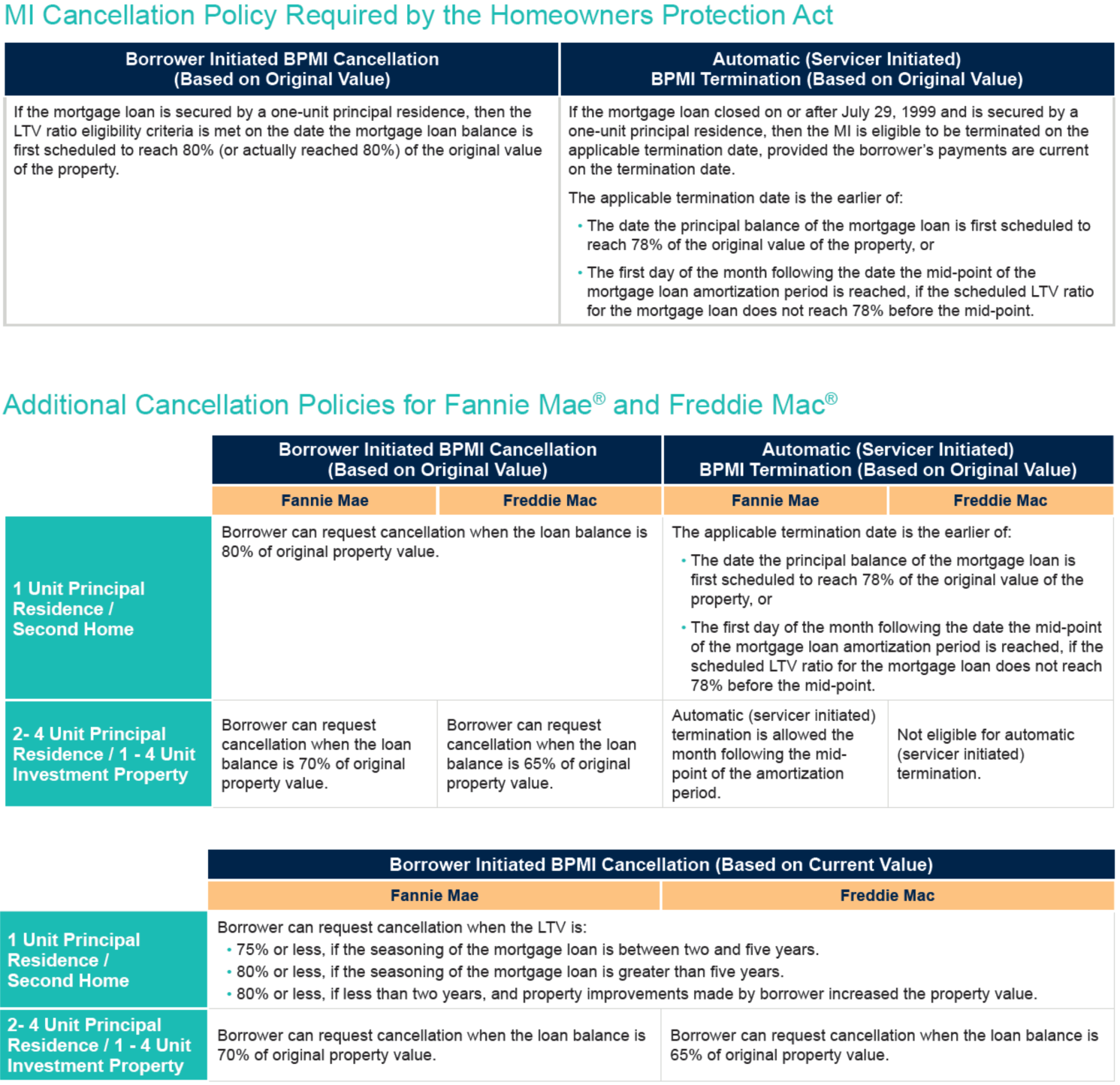

But you'll need to have at least 20% equity in your home and choose a. There is no way to get rid of the fha mortgage insurance premium (mip) after june 3, 2013, even if your loan was approved before then and you put down less than 10%. The federal homeowners protection act (hpa) provides rights to remove private mortgage insurance (pmi) under certain circumstances.

Some fha loan holders can get rid of their mortgage insurance premiums without refinancing. 3 ways to get rid of your pmi if you don’t want to wait at least a few years until you reach the 20% equity threshold to have your pmi removed, you have three other options. If your loan has met certain conditions and your loan to.

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance1-f53f53e537a14a069144d763f621795b.png)

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance3-371bab72617d42d28def5f93c622d6e5.png)